If so, economists refer to these goods and services as “normal.” However, sometimes higher incomes will reduce the demand for a good or service. These goods and services are called “inferior.” Clothing sold at a thrift store is an example of an inferior good. If it is inelastic, then a large change in price will result in a small change in demand.

- Luxury brands such as Louis Vuitton and Gucci are more than just clothing and become more of a status symbol.

- So long as they are not artificially controlled, prices provide an economic mechanism by which goods and services are distributed among the large number of people desiring them.

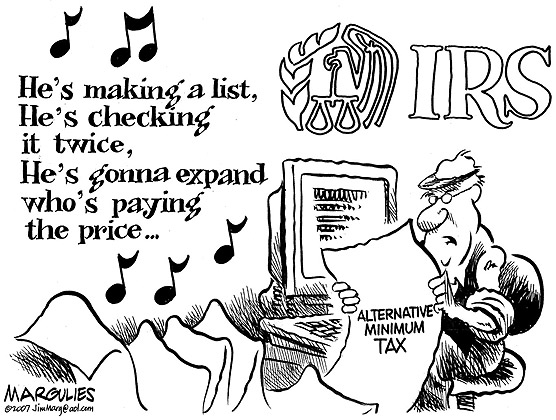

- In centrally planned economies, the price mechanism may be supplanted by centralized governmental control for political and social reasons.

- The line intersects the vertical axis where Amy spends her entire budget going out to eat.

The effect has little influence on items with few replacements, such as inferior goods or Giffen goods. If too much baking soda or powder is in the batter, the muffin will rise temporarily, then collapse. Price discrimination is also known as variable pricing or differential pricing. This can help to keep small businesses operating, create more job opportunities and ultimately lead to a more prosperous and equitable economy. An indirect cause-and-effect relationship describes a situation where an event or action causes an intermediate event, which in turn causes the ultimate outcome. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

Meaning of price effect in English

So, let’s apply this concept to some real-life scenarios; we’ll call our hypothetical wage earner Sally. Due to her limited income and the cost of groceries, Sally can only buy coffee once a month. Sally now has the income to buy coffee twice a month, and she doesn’t have to worry about making it last.

Hence the movement from 1 to N, or the decrease in quantity demanded of product B from Oe to Oh is the substitution effect. If consumers switch to the cheaper product when the price of one product increases, there is positive cross elasticity of demand between the two products. The term cross elasticity of demand refers to an economic concept that measures how responsive one good is to changes in the price of another. A product’s price is usually influenced by the prices of complementary and substitute products. The cross-elasticity of demand provides insight into the impact of the prices of these other products. The level of income of those buying the good or service is another determining factor in the price effect.

Price signaling

It is shown that when the price of the iPhone increases, the demand for Samsung phones increases. When considering the power of substitution, price is not the only factor to consider. A substitute good is a product that purchasers may exchange because of supply constraints or price considerations.

She would not choose a point below the budget line because she could increase her utility by purchasing additional items. For example, Amy would not choose T (five games and two visits to restaurants) because she could increase both the times she ate out and the number of ball games she attended while remaining within her budget. Amy would maximize her satisfaction by choosing Point X, the point on her budget constraint tangent to her highest possible indifference curve. Two economists, Slutsky and Hick, each define substitution effects differently.

Substitution and Cross Elasticity of Demand

Generally, consumers are expected to spend more when their income rises and less when their income falls. Income and spending correlations can also trend with economic cycles which are known to heavily affect the consumer discretionary and consumer staples sectors. Overall, higher income levels can lead to higher prices because consumers spend more and demand rises allowing businesses to charge more. The degree to which one good can be substituted for another is determined by the cross elasticity of demand, which measures the responsiveness of demand for one product to price changes for another. Price elasticity of demand measures how responsive demand for a product or service is to price changes. Price has little effect on demand, so demand is said to be inelastic.

In centrally planned economies, the price mechanism may be supplanted by centralized governmental control for political and social reasons. Attempts to operate an economy without a price mechanism usually result in surpluses of unwanted goods, shortages of desired products, black markets, and slow, erratic, or no economic growth. Suppose the ticket price of a game is cut in half, but the price of dining out remains the same. She would likely attend more games, but she may also dine out more because her available income has increased.

Multidimensional pricing

Rao and Kartono carried out a cross-cultural study to identify the pricing strategies and tactics that are most widely used.[10] The following listing is largely based on their work. Pricing is a fundamental aspect of product management and is one of the four Ps of the marketing mix, the other three aspects being product, promotion, and place. Price is the only revenue generating element amongst the four Ps, the rest being cost centers. However, the other Ps of marketing will contribute to decreasing price elasticity and so enable price increases to drive greater revenue and profits.

What is an example of price affecting supply?

For example, a business will make more video game systems if the price of those systems increases. The opposite is true if the price of video game systems decreases. The company might supply 1 million systems if the price is $200 each, but if the price increases to $300, they might supply 1.5 million systems.

It was common for homeowners to refinance their mortgages and save several hundred dollars each month. These savings increased available income and enabled consumers to purchase more goods and services than before lowering their mortgage payments. Price discrimination is a practice in which prices are set based on an individual customer’s willingness or ability to pay, rather than on the basis of a standard price list. This enables a company to charge more to customers who have higher incomes, more access to credit, and/or more experience in bargaining. The availability of substitute goods factor in to the price effect because it affects the choice a consumer has when they need a good or service. If the consumer has a wide range of substitute goods available to them, they may be more likely to choose a cheaper option when faced with a price increase.

Contents

Price elasticity of demand describes the expected change in demand per price change. The demand curve can be important for businesses in understanding the potential effects of a price increase or decrease in their offerings. Using a standard graph, the demand curve resulting from the substitution effect can pitched. On the graph, the Y-axis comprises of products A while the X-axis comprises of units of product B.

Cloud Cost Management Tools Market to Witness Remarkable … – Digital Journal

Cloud Cost Management Tools Market to Witness Remarkable ….

Posted: Mon, 19 Jun 2023 21:50:05 GMT [source]

The substitute good can be anything else that is purchased instead of the muffin. When any of these parameters change, substitute goods come into definition of price effect play. Firstly, it puts money into the pockets of employees which helps to boost the local economy and to create better standards of living.

What is the theory of price effect?

What Is the Theory of Price? The theory of price is an economic theory that states that the price for a specific good or service is determined by the relationship between its supply and demand at any given point. Prices should rise if demand exceeds supply and fall if supply exceeds demand.